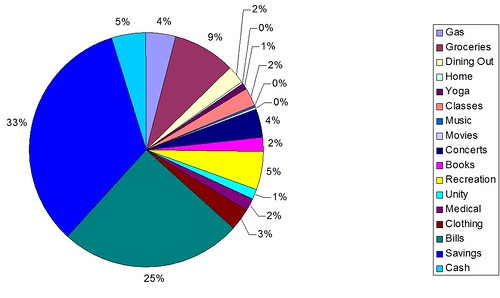

April 2011 Spending

Here is the breakdown of my spending for April. What this chart doesn't show is that I used $368.85 more than my income (including the 33% to savings). That doesn't mean I'm in debt, but I'm still spending from what is leftover in my checking account from before I was regularly adding to my savings.

I still have a lot of gray areas that I'm not sure what to do with. For example, I spent $67 on concert tickets for a show we are going to see in August (damn u ticket master). Does that money belong in this month's expenses, or August's? I am also thinking of integrating several of the 1 and 2% categories. Maybe use "Entertainment" to cover Music, Movies, Concerts, Books. And then perhaps "Personal Care" to cover medical, clothing, classes, home, and recreation (by "recreation" I always mean "the outdoors" which equals "health" to me). Oh and I also just noticed a charge I had in there twice! Wipe $4.66 off that overspent amount! A change I made in the breakdown this month is putting "cash" in for when I get cash from an ATM (except for when I know exactly what I spent it on). I may not always have the receipt for items in this case, and it feels more effective to at least account for that money. Oh man! I also noticed I put double charges in the books area! Knock off another $24.48! This is where I will note that I didn't keep up on my spreadsheet this month and just tried to enter a dozen receipts while checking against my credit card account, and therefore entered some doubles.

Sooooo, how to spend $339 less next month? No expensive concert tickets! No clothes! I bought a pair of everyday use sneakers so that I could preserve my running shoes for running ($25 over existing Zappos credit). I bought a pair of fancy waterproof boots for next winter because they were on a fabulous sale ($49 for Clarks brand). I am very happy with the sneakers, and I know I will be happy with the boots when I want to walk in the rain next winter, to events where motorcycle boots may not be appropriate. And it's worth mentioning that I am also getting rid of 16 other pairs of shoes at this time. I probably still have more shoes than I "need," but I do wear them all with regularity (AND THEY'RE ALL "SENSIBLE"). No books; I can get books at the library. If I take that $171 off, I'm left with $168 over. I spent $135 on a bike this month, that won't be an every month expense! Only $33 over. Now I noticed that I put a $20 donation in April when it really occurred in May. $13! Well that can be remedied by less dining out, easily.

PROBLEMS SOLVED! Can't wait to see how we do in May - with 2 days less income due to a vacation. How cheap can Liina and Kaden take a 4 day vacation for????????? STAY TUNED TO FIND OUT!

ps. I just said "we", but this reflects my expenses only, not Kaden's. We're married but keep our money separate.

6 comments:

I like your pie chart :)

I've started doing this too - I started in March. I can't do April totals yet, I get all my grocery store stuff so easily when I wait for their statements. I have two cards for different chains that register everything I buy from anywhere belonging to those chains. I know, they are totally using this for keeping tabs on what people buy! But they give you cash back rewards and sales soooooo....

It gets a bit complicated for me since we do share our money, even though we have separate accoounts. I put down rent, all the food, and any other bills plus my, and Indiana's expenses. Only my husband's personal stuff is left out. I guess I could do his as well at least somewhat, I would probably be safe just categorizing most of his purchases under "computer stuff" or perhaps some under "biking stuff". Anyway, what I already noticed from last month, is that we spend a lot of money on food (and I already knew that since we buy so much organic) but it might actually be as much as our rent. Well, it'll be interesting to see in a few months. I just put 1000 e (like 1400$) in our savings account. I was surprised to see so much money in my account and just promptly removed it to a safer place. I have no trouble keeping the savings off-limits, but in my regular account IT JUST WON*T STAY. I'm hoping to get better with that, but until now this is much better!!!

Yeah, I was really shocked by my grocery bill last month, and this month it was lower by almost exactly the amount I spent at one store, Costco, which I go to about every other month for large economy-size purchases (like a package of 8 cans of beans for a lower price than you can get individually).

I made the pie chart in Excel! It's a pretty great program.

My husband and I *do* share, but just by taking turns buying groceries or gas or whatever, and keep our bank accounts separate. But we do have a joint savings account that we opened when we received wedding gifts.

When you say you put the money in "a safer place," do you mean a different bank account? Here I have a checking account that I take money from, and a savings account that I would take money from if I had an emergency, but otherwise I don't touch. Then Kaden and I have a joint savings account that we will use if we ever decide to buy property or go on a mega-vacation or whatever, but we won't use it for everyday expenses.

It looks like you have a great idea of where all of your money is going Liina. Sometimes it's so hard to even figure out where the heck it went, let alone break it down to every last dollar like you've done here.

For the irregular expenses we seem to have every month (like your bike, boots, Costco, etc.) I build a set amount in our budget ($100) each month for these expenses. I know they're going to happen every month, but I just don't know what they'll be for! It really helps us stay on track to have that little monthly cushion.

Oh, and I would track your concert tickets on the month you paid for them, not the month you attend the concert. :)

It's really bizzarre how much I LOVE to see other people's budgets. Thanks for sharing!

Completely FASCINATING!!!!! I would LOVE to do this, but when I got pregnant I passed everything over to Brant. I gave him my debit card & said, "You take care of all of it. I don't want to hear about it, I don't want to think about it." Because everything was just TOO MUCH. And I haven't requested it back.

It's funny though, it ends up seeming super fucked up when I tell people my husband 'handles the money.' Like they think he's giving me an allowance or something!! Ha ha!

I always overspent impulsively. So for the time being I don't have to tackle that problem. Win-win.

Jenny - I just read that one of the steps in "Your Money or Your Life" is tracking EVERY PENNY, so I'm glad I got a head start.

Brandy - Yeah, I figure, whatever works for each couple is good for them! As long as it's consensual ;) Cree's wife does all their finances together. In our household, I pay the bills and Kaden pays me back half (mostly due to the fact that I ordered checkbooks and he didn't). Except I keep forgetting to send the rent haha. Oh and now you see that I am only tithing 1% (though I was also paying $10 a week for the Lent class, in my "classes" category)...I have really conflicted feelings on that subject, and I haven't decided on a permanent solution.

My wife and I aren't anywhere near this organized, but we have a general idea of where money gets spent - and we try to not buy stupid stuff.

I like the pie chart - did you just do that in Excel, or ... ?

Post a Comment